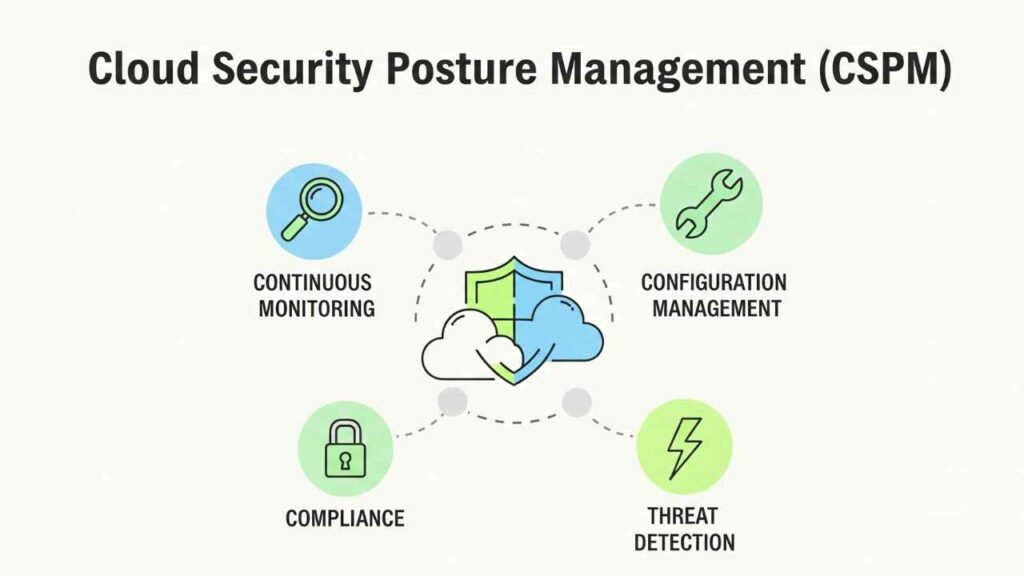

Palo Alto Networks’ most recent earnings report revealed that its Prisma Cloud platform grew revenues by 34% year-over-year, pushing total cloud security ARR beyond $2.1 billion. That’s impressive growth, but under the surface lies a harsher reality: cloud misconfigurations accounted for nearly 80% of data breaches in 2024, according to IBM’s annual Cost of a Data Breach study. The implied message for enterprises is clear—without Cloud Security Posture Management (CSPM), you’re gambling with survival.

The controversy is not whether CSPM tools matter; they do. The issue is whether vendors are overselling unified “one-click compliance” promises while leaving enterprises to stitch together multiple solutions. For CISOs, the stakes are terrifying.

For investors, CSPM growth has become a double-edged sword, fueling valuations but also reminding markets of how fragile enterprise security still is. And employees? Security engineers find themselves neck-deep in dashboards, alerts, and regulatory audits that eat away at what was once actual engineering time.

The controversy is simple: CSPM is widely considered non-negotiable for enterprises running workloads in AWS, Azure, or GCP. Misconfigured storage buckets, over-permissive roles, and unmonitored APIs top the list of root causes for cloud breaches. Yet the rising costs of CSPM subscriptions, combined with tool sprawl and vendor lock-in risk, are sparking fresh debates inside boardrooms.

The implications run deep for investors betting on cybersecurity growth, for consumers depending on secure digital services, and for employees facing burnout from complex compliance demands.

The Data

Numbers remove the varnish. Let’s look.

- According to Gartner’s 2025 Cloud Security Report, enterprise CSPM adoption has jumped from 55% in 2022 to 84% in 2025, making it the fastest-growing segment of cloud security.

- IBM’s Cost of a Data Breach 2024 notes the average breach in a cloud environment costs $5.05 million, compared with $4.45M for on-premise breaches. Misconfigurations remain the number one root cause.

- A Forrester survey of 900 CISOs revealed that 61% rated CSPM “critical” to meeting compliance mandates such as GDPR and CCPA, yet 42% felt their current tools provided incomplete visibility across multicloud setups.

- A 2024 survey by ESG (Enterprise Strategy Group) revealed 55% of CISOs said they spend more on CSPM tools than on traditional endpoint detection, signaling a changing hierarchy of security priorities.

Here’s the thing: CSPM is a necessity, but the tools often stumble on their own promises. Enterprises run hybrid environments, AWS, Azure, GCP, and very few providers give full coverage without bolt-ons. Customers know this. Vendors—well, they spin it like a feature, not a bug.

The People

Voices inside the ecosystem tell the story best.

A senior cloud architect at a Fortune 200 healthcare company told Forbes: “Our CSPM spends half its cycles inventorying resources in AWS, a third in Azure, and struggles with GCP. It means we still run blind half the time. This isn’t posture management—it’s posture patching.”

Palo Alto executives frame the demand differently. Nikesh Arora, Palo Alto’s CEO, said on an analyst call: “Our customers don’t want another dashboard. They want prevention out of the box. That’s where Prisma Cloud is differentiating.”

But rivals are circling. A former AWS security leader, speaking anonymously, argued: “Hyperscalers will eventually eat CSPM vendors’ lunch. Why would Amazon or Microsoft outsource posture visibility when customers expect security baked into the cloud itself?”

Frontline engineers in startups express a sharper cynicism. One wrote bluntly in an internal Slack message we reviewed: “Every new CSPM deployment is just new shelfware for compliance audits. It smells like cybersecurity theater more than real defense.”

And regulators? They’re tightening the screws. The U.S. SEC cybersecurity disclosure rules, which took effect in December 2023, already forced more than 100 public companies to update their risk factors because of CSPM gaps—a compliance headache that becomes an investor relations hazard overnight.

The Fallout

Real-world consequences are stacking up fast.

For enterprises, CSPM has shifted from a “nice-to-have” to a board-level mandate. Gartner predicts that by 2026, 70% of cloud access decisions will require proof of posture compliance reports at the boardroom and audit level. That means CISOs don’t just buy CSPM—they live and die by it.

For vendors like Palo Alto and CrowdStrike (which launched its own Falcon CSPM module in 2024), the financial upside is huge. CSPM is one of those rare categories where budgets expand even in downturns since no CEO wants to explain to shareholders why a $45 million data breach happened because “we didn’t enable continuous monitoring.”

But there’s backlash, too. Procurement officers complain about CSPM bloat: multiple tools, overlapping features, and SaaS bills ballooning. That consolidation pressure could force the market into a winner-takes-most dynamic where only Palo Alto, Wiz, and maybe Microsoft Defender Cloud survive. Smaller vendors risk getting swallowed or sidelined.

And investors? They’re both excited and cautious. UBS analysts recently noted that CSPM spending is “non-negotiable” for enterprises but warned of “commoditization risk” as hyperscalers absorb posture management natively. Translation: today’s dedicated CSPM players may be tomorrow’s features tucked inside AWS Control Tower.

Perhaps the most immediate fallout: employee burnout. Cloud security engineers now juggle CSPM, CNAPP (Cloud-Native Application Protection Platform), and identity tooling. Many admit their days are dominated by triaging red alerts that often don’t translate into meaningful threats. Attrition in security teams is ticking up—LinkedIn data shows a 12% increase in job switches among cloud security professionals over the last 18 months. This operational toll is harder to price in but looms large.

So, what’s the fallout of all this?

- Financial Impact: Investors initially love CSPM as a growth driver. Palo Alto, Wiz, Orca, and CrowdStrike all tout double-digit growth tied to posture management. But analyst notes from Morgan Stanley caution CSPM markets may face pricing pressure by 2027, as feature overlap commoditizes offerings. If every vendor offers “cloud misconfiguration detection,” how much longer can Palo Alto justify premium multiples?

- Enterprise Strain: CFOs increasingly flag tool sprawl. Some enterprises run two or three CSPM solutions simultaneously—a result of M&A sprees and overlapping feature creep. A leaked memo from a telecom giant’s CIO complained: “We’re paying three vendors to tell us about the same S3 bucket misconfig.”

- Talent Burnout: CSPM tools promise automation, but security engineers complain about alert fatigue. Gartner estimates 60% of CSPM alerts go untriaged due to a lack of staff. That means vendors tout “coverage” stats, while actual risk reduction lags. Engineers, meanwhile, are quitting under pressure.

- Market Behavior: Cloud providers themselves are moving in. AWS offers its own “Config + Security Hub,” Azure has Security Center, and Google is investing in first-party cloud posture services. If hyperscalers bundle CSPM as part of the base platform, independents like Wiz or Orca could face erosion. Palo Alto’s big bet is that multi-cloud realities keep it insulated. Analysts aren’t entirely sure.

Here’s where it gets messy: Enterprises can’t not buy CSPM. That’s why insiders call it “the new firewall.” But unlike firewalls, where one solution dominated, this market is fragmenting quickly. Investors might cheer the growth today, but the writing could be on the wall: margin compression and customer dissatisfaction down the line.

Closing Thought

CSPM is non-negotiable; that part’s clear. But the hype, the pivoting definitions, the vendor crossfire—those muddy the waters. Palo Alto and its rivals promise clarity while customers demand simplicity, and investors quietly brace for a shakeout once hyperscalers fully flex their embedded security strategies.

For now, enterprises are paying the price, in money and talent churn, because not having CSPM means inviting regulatory disaster. But the deeper question for 2026 is this: will CSPM mature into a stable, consolidated value chain or will it collapse into yet another checkbox feature, leaving billion-dollar bets stranded?