Shares of Amazon ticked up 4% after AWS announced another quarter of double-digit growth, thanks not just to AI hype but a quieter, less sexy shift: enterprises are finally breaking up their aging monoliths into microservices. For CTOs, that technical migration is no longer a nice-to-have—it’s shaping up as the defining software architecture decision of the decade.

The catch? Migrating to microservices isn’t only an engineering problem. It’s about risk, talent shortages, spiraling cloud bills, and boardroom pressure to stay competitive with nimbler rivals. Amazon, Microsoft, and Google all want to be the enabler. But insiders admit the transition has become messier than investors realize—especially when CFOs start looking at ballooning AWS bills.

The Data

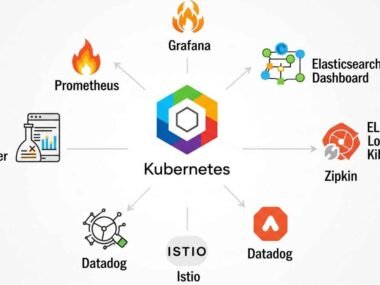

The numbers tell a story big enough to keep every CTO awake at night. According to Gartner, by 2027, more than 90% of digital enterprises will rely on microservices architectures in some form. Today, it’s closer to 40%. That gap explains why AWS is pushing hard on products like Lambda and its managed Kubernetes service, EKS. The market for cloud-native applications is expected to reach $12.5 billion next year, IDC estimates.

Even conservative analysts concede the financial stakes are massive. JPMorgan data shows enterprises making the leap to microservices run 30-50% faster deployment cycles compared to monolith-heavy peers. That kind of agility becomes a revenue multiplier. At the same time, Gartner warns that enterprises report a 20-25% surge in cloud costs during early migration phases—costs that sometimes shock CFOs into calling emergency budgeting sessions.

Migration is no longer a fringe experiment. According to Gartner’s 2024 Enterprise Software Report, over 75% of large organizations will have adopted some form of microservices by 2026, compared with just 30% in 2020. IDC adds another twist: companies that successfully complete the shift see a 40% reduction in time-to-market for new features.

Amazon has doubled down. Internal disclosures cited by The Information in late 2024 showed that AWS’s service-based revenues in areas tied to microservices (like Lambda compute and container orchestration) have grown 29% year-over-year, outperforming its traditional storage and raw compute contracts.

And yet the costs still sting. A mid-size financial services company investing $50 million in migration reported that only 60% of its teams hit on-time delivery benchmarks, according to tech consultancy ThoughtWorks. The rest? Delayed launches, ballooning costs, and in some cases, hiring freezes. This smells like optimism with a thin layer of risk.

Here’s the thing: while the dream is faster innovation, the invoice for microservices can look ugly in the short term. And that’s reshaping the calculus in executive suites from Minneapolis to Mumbai.

The People

For engineers, the story feels familiar but urgent. “Moving from a monolith isn’t about microservices as much as it’s about people,” a former Amazon architect told Forbes. “Most companies underestimate the leadership and cultural friction more than the technical lift. That’s where projects stall.”

A CTO at a Fortune 500 bank echoed that view, saying the shift felt less like a migration project than a “slow-motion brain transplant that requires retraining 2,000 developers on a new way of thinking.”

Investors don’t see the scars behind those metaphors. They see accelerated timelines and digital transformation narratives in quarterly reports. But inside companies, microservices rollouts often spark turf wars between product and engineering divisions. Sometimes, entire dev teams balk at “losing” the comfort of their well-known monolith.

Even AWS leaders admit the road is longer than customers imagine. AWS VP Werner Vogels once quipped in a private event that “microservices are the future, but nobody said the future was cheap or simple.” That comment, according to sources, drew nervous laughter from a room full of CIOs but has since been repeated quietly among IT strategists.

“A monolith to microservices journey isn’t linear—it’s chaos wrapped in ambition,” said Jamil Hussein, former cloud architect at Amazon, in an interview. He hinted that Amazon’s internal teams once faced exactly what many enterprises now deal with: broken dependencies, uneven skill sets, and frustrated leadership trying to prove ROI before investors lost patience.

Another insider, a current CTO at a Fortune 500 bank, put it less delicately:

“The pitch was speed and agility. What we got, at least in the first year, was a spaghetti bowl of APIs, ballooning vendor contracts, and sleepless engineers. Amazon sold us a vision. Delivering has been harder.”

Still, defenders argue this pain is temporary. Software modernization inevitably has a “trough of disillusionment.” The reward is agility: faster releases and workloads that scale with market swings. Or at least that’s the narrative.

The Fallout

The ugly truth? Failures pile up. Several Fortune 1000 enterprises have seen multi-year overhauls shelved after budgets spiraled. Bloomberg reported that one U.S. healthcare giant spent three years and over half a billion dollars dismantling its monolith—only to discover that latency problems had worsened under microservices. The fallout included two executive departures and a public readjustment of IT guidance.

On the other side of the spectrum, success cases fuel the hype machine. Netflix famously scaled its service by pioneering microservices, running thousands of them seamlessly worldwide. Now every CIO waves the Netflix slide deck at board meetings as proof of what’s possible. Yet Netflix’s atypical engineering culture makes that blueprint less replicable elsewhere.

Analysts say the broad impact of staggered migrations could hit Wall Street’s favorite narrative: cloud as an infinite growth engine. If enterprises discover that microservices adoption is slower, costlier, or less beneficial than promised, AWS, Microsoft Azure, and Google Cloud could face investor skepticism. Already, some hedge funds are whispering that the “microservices gold rush” looks a lot like last decade’s Hadoop pivot—mass adoption that later left many enterprises disillusioned.

This smells like the kind of hype cycle correction that trims billions off market caps when growth forecasts get too rosy.

Closing Thought

The enterprise playbook is being ripped apart and rewritten in real time. Amazon and its rivals are still betting CTOs will eventually conform to the microservices mantra, like it or not. But developers grumble, CFOs slam calculators shut, and investors want clear productivity metrics, not vague “digital transformation” promises.

The big question now: will this architectural bet cement Amazon as the indispensable operating system of enterprise software—or will the costs, culture wars, and broken migrations spark a backlash that slows the movement before it hits mass saturation?