Shares of cloud-focused tech giants wobbled this summer after a little-noticed Goldman Sachs survey revealed that 82% of enterprise customers are cutting or reconsidering cloud spending by 2026. Investors didn’t exactly panic, but the numbers sparked uncomfortable conversations. Suddenly, attention shifted from growth headlines to a much thornier issue: hidden costs lurking inside the cloud computing ecosystem.

This isn’t just a story about balance sheets. It’s about who pays when a business signs a multiyear cloud contract, whether a startup or a Fortune 500. And here’s the thing: those costs don’t stop at line items. They ripple—to engineers, CFOs, and ultimately, investors who believed the “cloud saves money” narrative. Now, cloud providers—Amazon Web Services (AWS), Microsoft Azure, and Google Cloud—are being forced to defend their margins in the face of mounting backlash.

The Data: Numbers Behind the Cloud Mirage

On paper, the cloud market looks untouchable. According to Synergy Research Group, global cloud infrastructure services revenue hit $76 billion in Q2 2025, a 19% year-over-year jump. AWS controlled roughly 31%, Microsoft Azure 25%, and Google 11%. That doesn’t sound like trouble until you dig deeper into profitability and usage patterns.

Gartner data paints a slightly different picture: 75% of organizations reported “unexpected cost overruns” in cloud projects by year three. A McKinsey study last spring claimed that companies waste on average $120 billion yearly on underutilized cloud resources, with 30–40% of provisions never reaching meaningful utilization. That’s not an error—it’s a systemic leakage.

Let’s add another wrinkle. In earnings calls, Amazon executives repeatedly highlight “cost optimization efforts” from corporate customers. That’s code for companies scaling down what they no longer need—or can no longer justify. To Wall Street, that means slower growth in the very unit propping up Amazon’s profits.

The fact pattern is clear: the cloud is growing, but so are complaints about its hidden price tags.

The People: Insiders Speak Out

Here’s where it gets uncomfortable for providers. Several insiders—former executives, consultants, and even a few outspoken CIOs—are breaking what was once a polite silence.

“AWS made it dangerously easy to spin up workloads. The problem? That convenience hides financial traps—network egress fees, long-term lock-ins, costs that triple if you didn’t size your architecture perfectly on day one,” said a former AWS enterprise account manager who left in 2023.

Another voice comes from FinOps Foundation, an industry body focused on cloud cost optimization. Its chair told Forbes in June: “Cloud providers don’t design pricing models to be intuitive. They design them to be sticky. Customers often pay for complexity they don’t understand.”

Even more telling: a senior engineer at a Fortune 50 firm confided anonymously, “We literally had to build a shadow internal team just to audit the cloud bill. Some months it looked like our ‘savings’ cost us more than if we had built everything on-prem.”

It smells like the déjà vu of telecom providers 15 years ago—low sticker price, high hidden fees.

The Fallout: Investors Raise Eyebrows

So, what does this mean in the real world? A few key threads are starting to show:

- For Customers: CFOs are rethinking cloud-first mandates. Big enterprises like Capital One and Dropbox have already pulled workloads back on-premises. Analysts now predict a modest but growing “cloud repatriation” trend. Gartner estimates 20% of companies will move significant workloads out of public cloud by 2027, chasing cost control.

- For Employees: Engineers are caught in the middle. Instead of innovating, many tech teams are tasked with “cost arbitrage”—deciding whether storage should live in AWS Glacier, Azure Archive, or on an in-house rack. It’s tedious work that kills morale.

- For Investors: The math doesn’t lie. If 30–40% of provisioned cloud resources go unused, efficiency eventually becomes the investor debate. Analysts at JPMorgan recently downgraded Amazon stock partly on fears that AWS growth “would decelerate below consensus” as cost-cutting accelerates. Microsoft and Google are not immune, as both report narrowing operating margins in their cloud units.

The fallout isn’t just slowing growth. It’s something deeper: the trust narrative is cracking. The cloud was once sold as elastic, affordable, and liberating. Now, the very elasticity seems like a trapdoor.

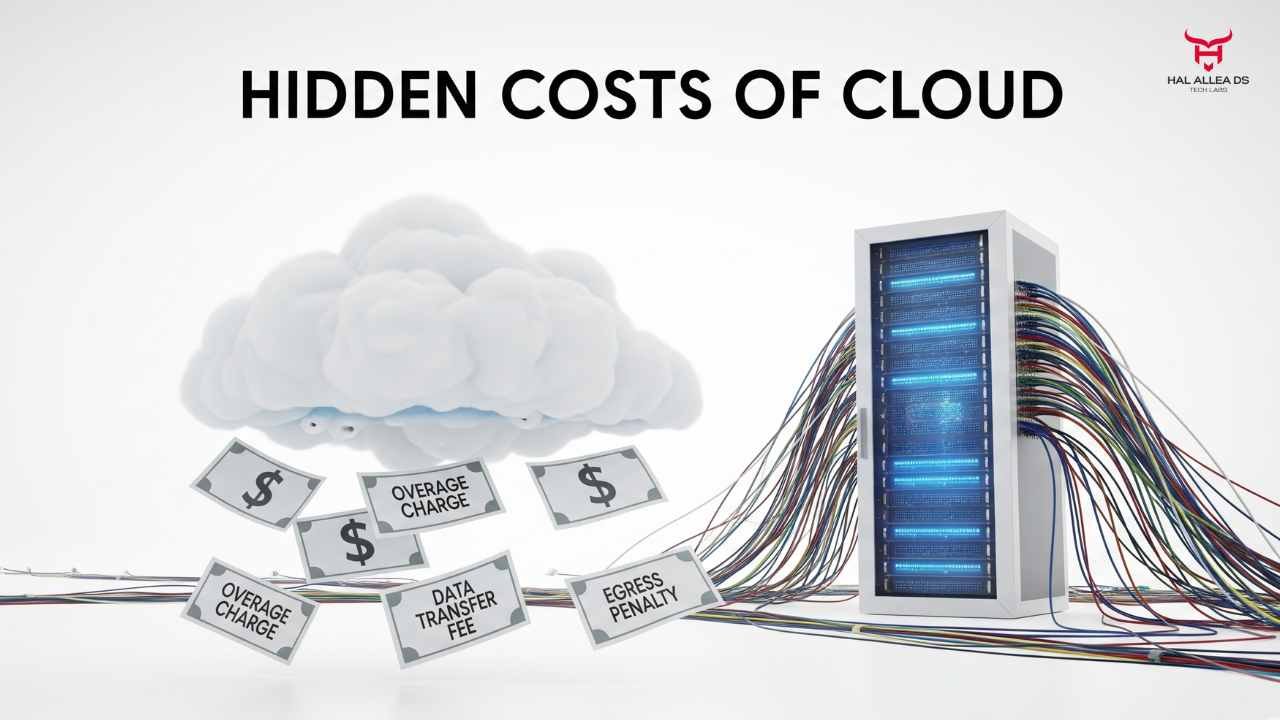

Digging Into the Hidden Costs

Let’s break down where the surprise charges emerge:

- Data Egress Fees: Moving data out of a provider is notoriously expensive. In some cases, 10x the cost of storage itself. Think of it like paying more to leave a hotel than to stay a night.

- Over-Provisioning: Because pricing tiers are confusing, engineers overshoot. What was supposed to be a $5,000 workload mushrooms into $50,000 monthly.

- Licensing Lock-Ins: Many legacy enterprise software vendors tie their best licensing rates to one provider partnership, boxing customers in.

- Support Contracts & Monitoring Tools: Often ignored, these line items can bloat monthly bills by 10–15%.

This isn’t lazy procurement. This is structural opacity. And opacity means margins—for providers.

A Counter Spin From the Providers

Of course, the providers see it differently. AWS PR insists it gives customers “industry-leading cost visibility,” pointing to its Cost Explorer tools. Microsoft regularly cites its FinOps partnerships. Google markets “sustainable pricing” as its differentiator.

But scratch the surface, and those narratives look more like damage control. For instance, Cost Explorer helps—but it doesn’t change pricing architecture. Azure offers “reserved instances” for predictability—but those require multi-year lock-in, which defeats the original “pay as you go” promise.

This is where skepticism becomes hard to hide. If providers truly wanted transparency, why not simplify rates instead of layering new tools to explain old bills?

Historical Echoes: Tech’s Oldest Trick

We’ve seen this movie before. In the early 2010s, mobile operators engineered pricing with unlimited-but-not-really data plans. Before that, enterprise software vendors wrote perpetual contracts where the devil lived in maintenance fees. Cloud was supposed to break that mold. Instead, it looks uncomfortably similar.

“History suggests complexity is rarely an accident in pricing, it’s a feature,” says Paul Daugherty, tech analyst at Accenture. “And when an entire sector relies on sticky complexity, disruption eventually follows.”

Avoiding the Trap: Emerging Alternatives

The critical question isn’t just what’s wrong, but how to avoid it. The answers are evolving:

- FinOps Discipline: A growing movement that treats cloud costs like supply chain management. Dedicated teams track spend in real-time, enforce accountability, and negotiate terms proactively.

- Multi-Cloud & Open Standards: Instead of wedging everything into one provider, some firms distribute across AWS, Azure, and Google. It adds operational complexity but reduces hostage risk.

- Cloud Repatriation: Building private clouds on systems like VMware, Nutanix, or even plain metal data centers is back on trend. Not for everything, but for predictable workloads. Dropbox famously saved $75 million over two years after migrating data storage off AWS.

- New Entrants: Upstarts like Wasabi and Backblaze now pitch themselves as “the anti-cloud cloud”—flat-rate pricing, no hidden fees. Their market share is tiny, but their message resonates with cost-conscious startups.

The Investor View: Clouds With a Shadow

Wall Street rewards consistent growth and predictable margins. The hidden-cost saga threatens both. Goldman Sachs analysts wrote in July: “Cloud economics are under far greater scrutiny than investors appreciate. Enterprise IT budgets are flattening, and optimization trends have not yet been fully priced into expectations.”

Translation: expect volatility. If AWS growth slows even 3–4 points, Amazon’s total operating income could slip by billions. Microsoft’s Azure carries similar exposure. Google Cloud, while smaller, relies heavily on enterprise wins to offset its advertising cyclicality.

Here’s the wildcard: regulation. European Union lawmakers already probed cloud exit costs earlier this year, arguing egress fees restrict fair competition. If regulators crack down, margins could shrink further, potentially redrawing the competitive map.

Closing Thought

The cloud was never supposed to be complicated. It promised liberation from servers, racks, and headaches. Instead, it now feels like déjà vu: another utility where customers shrug at opaque bills and wonder how it got this messy.

Which raises the bigger question—will the hidden costs push enterprise customers, and by extension investors, to finally demand a new model? Or do Amazon, Microsoft, and Google remain so entrenched that complexity is simply the price of admission?

Because if there’s one thing markets dislike more than hidden costs, it’s realizing too late that growth was paid for by opacity all along.