Shares of Microsoft have surged nearly 48% in the past 18 months, largely fueled by excitement around its partnership with OpenAI and its integration of artificial intelligence into core products like Azure and Office 365. On paper, that growth cements Microsoft as a frontrunner in the AI race. Yet beneath the stock-market enthusiasm, something more complicated is emerging: Chief Financial Officers (CFOs) across industries are attempting to measure the real return on investment (ROI) of these sweeping AI deployments—and the math isn’t simple.

Here’s the thing: while Wall Street rewards the AI story, companies footing the bill are privately anxious. Licensing models, spiraling infrastructure costs, and the unpredictability of machine learning adoption are raising red flags for finance chiefs who are expected not just to fund “innovation,” but to justify it in bottom-line terms. For employees, that translates into mounting pressure to incorporate AI-driven workflows, while shareholders are wondering if the hype will eventually crash into reality.

The Data

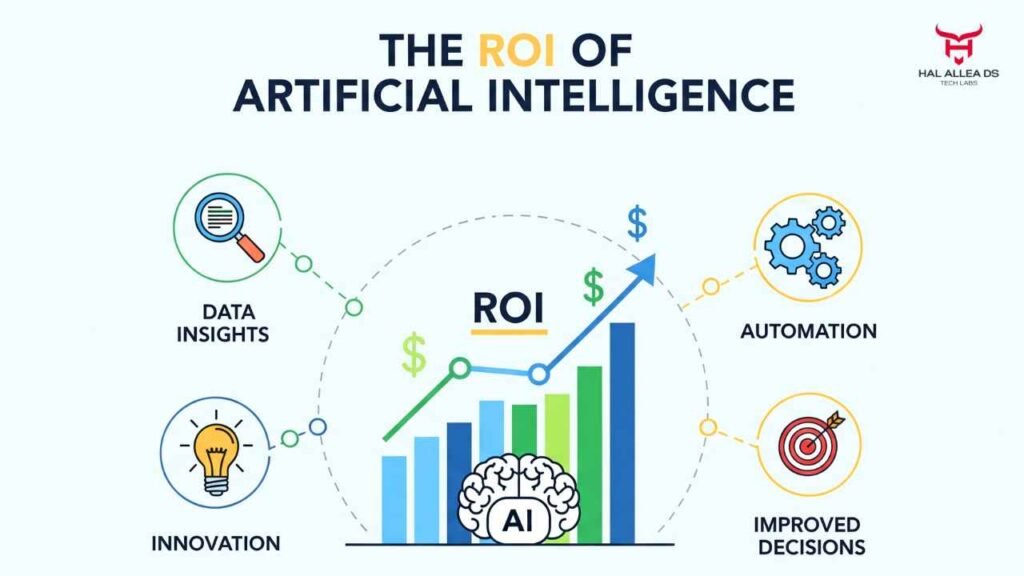

According to Gartner’s 2024 CFO Survey, 71% of finance leaders reported that “AI projects have underperformed expectations on ROI in the first year of deployment.” Only 18% considered machine learning investments “clearly profitable” in the same timeframe. At the same time, global spending on AI is projected to exceed $300 billion annually by 2027, per IDC. That’s a staggering bet when most firms are struggling to quantify savings beyond vague productivity metrics.

According to Bloomberg Intelligence, corporate AI spending exceeded $200 billion globally in 2024, doubling from 2022. Financial services accounted for about 15% of that, making it the third-largest industry investor after tech and healthcare.

Goldman Sachs reported in its 2025 second-quarter earnings call that its AI-driven initiatives, including risk modeling systems and client advisory automation, were absorbing roughly 12% of annual operating expenses. By comparison, in 2019, tech investment stood at about 4%.

Microsoft, for its part, claims its AI features—particularly embedded Copilot tools—are lifting worker efficiency by as much as 29% in certain pilot programs. But even that number has caveats: the study was conducted internally and not peer-reviewed. “Take those productivity stats with a grain of salt,” said a financial analyst at Cowen. “Self-reported gains rarely align with actual cost savings.”

The paradox is sharp. Adoption is rising fast—as of late 2025, roughly 58% of Fortune 500 firms had licensed some form of Microsoft Copilot, OpenAI, or an equivalent generative AI service, according to Bloomberg Intelligence. But profitability from those same tools remains elusive. CFOs are asking a blunt question: Is AI truly driving competitive advantage, or just creating new line items for cloud expenditure?

McKinsey estimates that AI could unlock $1 trillion in annual value for global banking by 2030. But that forecast comes with a caveat—returns are “uneven and delayed,” often taking five to seven years to materialize at scale.

The People

“This is the new corporate arms race,” a former Microsoft executive told me on condition of anonymity. “No CFO wants to be the one telling a CEO, ‘We didn’t keep up with AI adoption.’ That fear is a major driver—but fear is not a financial strategy.”

Inside Microsoft, employees describe mixed reactions. Some engineers praise Copilot as a remarkable step-change in productivity, freeing developers from routine coding. Others complain that integration has been rushed, creating “ghost costs” in the form of re-training, redundant pilots, and mismatched deployments. “Half our clients are licensing features they don’t use,” said a senior account manager. “Nobody wants to be left behind, but plenty don’t really know what they bought.”

Investors aren’t blind to these signals. Hedge funds with significant Microsoft exposure are quietly pressing for disclosure on the actual cost-benefit analysis of AI investment. One fund manager I spoke with called the situation “eerily reminiscent of early cloud migration,” where costs ballooned for years before efficiencies materialized.

Inside Goldman Sachs’ Manhattan tower, the rollout of AI tools is reshaping workflows—and careers. A managing director described the firm’s AI program as “the most aggressive internal transformation since electronic trading.” Teams once packed with junior analysts now rely on machine learning models that can crunch pitch decks, insights, and comparable deals in minutes.

But this isn’t just about “efficiency.” For employees, the undertone is existential. “There’s an unspoken reality,” said a VP in the investment banking division. “In the past, you’d build a career working through thousands of hours of Excel modeling. That was training. Now, the AI does it faster, cleaner. Great for clients, but what happens to the pipeline of careers?”

It’s not paranoia. According to a 2025 Reuters report, automation has already cut analyst hiring across Wall Street by 30% since 2021. Firms say they’re “retraining talent,” but insiders whisper about a slow hollowing of the middle—an erosion of the apprenticeship system that fueled Wall Street’s hall-of-fame dealmakers.

Still, senior leaders paint a rosier picture. CFO Denis Coleman told shareholders in July: “This is about augmentation, not elimination. We’re aligning our smartest people with smarter tools to unlock alpha at scale.”

That line landed well in the room. But behind the scenes, even some partners admit the economics aren’t convincing—yet.

The Fallout

Here’s where the tension gets real: financial reporting requirements are forcing CFOs to be more explicit about AI-related costs. Under new SEC guidelines, companies must disclose “material expenditure on AI infrastructure or services” that could impact profitability in the near term. That has opened the books in ways that investors didn’t see during the first year of AI mania.

For Microsoft, the fallout shows up in CapEx. In its last quarterly statement, the company revealed a 23% jump in capital expenditures, totaling $18.5 billion, driven largely by investments in cloud infrastructure to support generative AI workloads. Analysts now predict Microsoft’s operating margins could compress in 2026 if enterprises slow their spending after hype-driven adoption phases wear off.

This pattern isn’t unique to Microsoft. Large enterprises report hidden costs in AI: integration delays, compliance reviews, and workforce retraining. CFOs are discovering that machine learning doesn’t just replace human labor—it shifts costs into new categories, sometimes less predictably. “It’s not about outright savings, it’s about cost reallocation,” said a Deloitte partner advising Fortune 100 firms. “The ROI conversation is more complicated than anyone wants to admit.”

Meanwhile, employees are caught in a cultural shift. AI is being touted as a co-pilot, but in many roles, it looks more like a supervisor. Performance metrics now assume AI-enabled productivity, effectively raising baseline expectations. That creates a hidden form of labor intensification—one rarely visible in an earnings call—but one employees feel acutely.

Closing Thought

The hype is far from over. Microsoft remains the dominant player in enterprise AI, and Wall Street still rewards every incremental announcement with a bump in valuation. But as CFOs sharpen their pencils, the narrative is shifting from “AI will transform everything” to “show me the money.”

And here’s the provocative question: when the dust clears, will Microsoft’s AI push be remembered as the moment corporate America found real financial leverage in machine learning—or as the peak of a hype cycle where costs outpaced benefits?