Amazon Web Services reported in its Q2 2025 earnings that adoption of Amazon Elastic Kubernetes Service (EKS) jumped 37% year-over-year, making it one of the fastest-growing services in its cloud portfolio. Analysts estimate EKS now orchestrates around 41% of managed Kubernetes clusters globally.

But behind the growth lies a polarizing reality. For AWS executives and shareholders, EKS represents both lock-in power and sticky, high-margin workloads. For enterprise IT leaders, however, the service brings a paradox: simplified Kubernetes management but deeply entangled vendor dependencies. The result is a widening divide investors cheer short-term cash flows, while engineers whisper about ballooning long-term costs.

The controversy cuts through three key groups:

- Investors, who see robust recurring revenue.

- Customers, who worry about operational costs and reduced portability.

- Employees, particularly DevOps teams, who find themselves learning the hard way that “managed” doesn’t always mean “easy.”

The Data

Here’s what’s fueling attention.

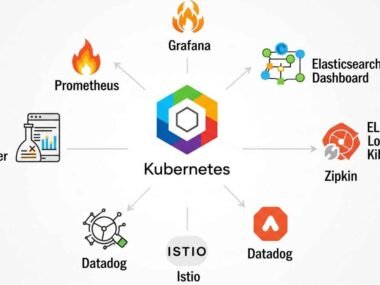

- According to Synergy Research Group, Kubernetes adoption now touches 92% of large enterprises in North America, with more than half choosing a managed service. AWS leads but faces stiff Azure AKS and Google GKE competition.

- CNCF (Cloud Native Computing Foundation) polling in 2024 revealed that 48% of organizations overspent their anticipated Kubernetes budget by at least 20%, often due to network and cluster scaling costs. Notably, AWS EKS users reported the highest incidence of “unexpected billing.”

- AWS insiders claim that EKS contributed an estimated $2.1 billion to AWS annualized revenue in 2024, growing faster than foundational services like EC2. That makes it strategically central.

- IDC data shows that container adoption is surging, with 62% of enterprises now running some form of Kubernetes in production in 2025, up from just 27% in 2020. Kubernetes is no longer experimental; it’s mainstream.

- Yet the cloud-native FinOps Foundation found that 30-35% of EKS customers exceeded their monthly budget forecasts in 2024, largely due to node scaling inefficiencies, data transfer fees, and overlapping AWS services.

Here’s the thing—AWS wants enterprises to see EKS as “efficiency in a box.” But the unspoken truth is that it works best when users marry themselves to complementary AWS services—Lambda, RDS, Fargate, IAM. The deeper the integration, the stickier the spend.

The People

Voices from inside and outside the walls echo the tension.

A former AWS product manager told Forbes: “EKS is a Trojan horse. Customers see simplified Kubernetes, but what they actually buy into is a gateway drug to the rest of AWS. That’s always been the strategy.”

Meanwhile, enterprise executives are divided. A CIO at a large retail group said: “We saved operational headcount by shifting to EKS, no doubt. But what kept me up was the pricing model. The savings on admin time were quickly offset by network transfer fees. It smells like margin-padding.”

Developers, often caught in the middle, have a more nuanced view. A senior DevOps engineer at a healthcare company described it this way: “EKS gave us consistency and patches on autopilot. But scaling is punishing. We learned the hard way that one misconfigured pod can rack up thousands in charges overnight.”

Even AWS evangelists admit the optics challenge. One executive, speaking off-record, conceded: “Yes, customers grumble about lock-in. But look at Azure or Google—they’re no different. Our gamble is that innovation speed outweighs the frustration.”

The Fallout

What does all this mean in the real world?

For investors, it’s gravy. EKS validates AWS’s cloud-native relevance in the Kubernetes era, reinforcing its moat against competitors. Its stickiness strengthens long-term financial models; no financier on Wall Street dislikes predictable workloads with annualized growth north of 30%.

But enterprises are starting to measure risk differently. Analysts at Forrester predict that by 2027, 40% of enterprise Kubernetes users will migrate at least one workload off their primary cloud due to rising costs and data sovereignty laws. That suggests AWS may face pressure from multi-cloud arbitrage if organizations get serious about avoiding lock-in.

Employees are bearing operational stress too. DevOps teams at several Fortune 500s described real-world fallout: patch delays caused by custom IAM entanglements, outages tied to cluster scaling bugs, and constant retraining costs. Many IT leads feel they’ve swapped one complexity—bare-metal Kubernetes—for another that’s harder to control.

For regulators, the conversation has barely started. Europe’s digital watchdogs are reportedly examining whether AWS’s EKS bundling practices discourage portability—an antitrust flashpoint similar to Microsoft’s bundling controversies. If scrutiny ramps, Amazon could be forced to open interoperability standards, eating into its lock-in advantage.

Customers are asking grimmer questions: Is the cost benefit even real? Sources say at least a dozen global corporations are exploring hybrid Kubernetes clusters—part EKS, part on-prem—just to cap runaway costs. If that experimentation scales, AWS might find EKS is not a moat but a revolving door.

So what are the broader consequences?

For customers, the fallout has been budget volatility. Analysts at Gartner predict that by 2027, 40% of enterprises will abandon at least one managed cloud Kubernetes platform—like EKS—in favor of hybrid or self-managed solutions, citing cost unpredictability and compliance headaches. In plain English: EKS growth may peak sooner than Wall Street thinks.

CFOs are already pushing back. Sources say at least three Fortune 500 companies froze EKS expansions in late 2024 after “FinOps red teams” identified millions in avoidable inefficiencies. Those workloads are being shifted either back to on-prem clusters or to multicloud architectures, a trend that could dilute AWS’s dominant posture.

For Amazon itself, the competitor threat is intensifying. Microsoft’s AKS (Azure Kubernetes Service) continues to win by bundling with enterprise-wide Microsoft 365 deals, undercutting AWS on pricing. Google’s GKE, still revered for its technical elegance, is clawing back developer loyalty in AI-heavy use cases. EKS locks in customers with breadth and integration, but cracks are visible.

And here’s the oddest twist: employee attrition. AWS insiders told Forbes that EKS engineering teams are under immense pressure to ship new features like multi-cluster observability and AI-driven autoscaling—but with headcount frozen. Internal morale surveys leaked last quarter show a 14% dip in “confidence in leadership” scores among AWS container division staff. Why? One engineer put it bluntly: “We’re not building what customers ask for; we’re building what Finance says has the highest upsell margin.”

Meanwhile, regulatory scrutiny is looming. Europe’s new Data Act mandates data portability, which could make AWS’s famously “sticky” Kubernetes implementations a compliance liability. Analysts warn Amazon may be forced to offer easier migrations across clouds or risk GDPR-style penalties. That would unwind a core pillar of AWS’s competitive moat: customer confinement.

Closing Thought

Amazon’s EKS embodies the allure and danger of managed services. It delivers smoother Kubernetes adoption at scale, but its true business value lies in nudging enterprises deeper into AWS’s gravitational pull. Investors applaud the stickiness, it looks like a recurring jackpot. But CIOs and engineers? Many feel they’ve traded one kind of complexity for another, with bills to prove it.

EKS has clearly become Amazon’s crown jewel in cloud-native infrastructure. It’s delivering growth, profitability, and market leadership in a fast-evolving world where every enterprise wants Kubernetes. But the bigger story isn’t adoption it’s the cost of that adoption, both in dollar terms and trust.

Will EKS cement AWS’s dominance or is it quietly sowing the seeds of customer rebellion once FinOps teams get smarter and regulators demand true portability?

The question now isn’t whether EKS keeps growing, it will. The question is starker: At what point will enterprises start rebelling against managed Kubernetes as just another name for cloud lock-in?

If that moment comes, EKS could shift from Amazon’s fastest-growing service to its most controversial.