In its latest quarterly update, Red Hat reported a 31% surge in adoption of its OpenShift GitOps module, with over 1,200 enterprise customers now managing production workloads through Git-driven automation. That jump marks one of the fastest-growing segments in Red Hat’s portfolio, and it didn’t go unnoticed: IBM’s stock edged up 4% on the news, adding roughly $18 billion to its market cap in a single week.

But here’s the thing, this surge isn’t without controversy. GitOps, the practice of managing infrastructure and application deployment declaratively via Git repositories, is being hailed as the “new DevOps.” Proponents call it the inevitable evolution of cloud operations; critics say it’s an over-engineered fad that adds complexity while promising simplicity.

The impact touches everyone in the value chain: developers facing new workflow paradigms, CIOs balancing security risks with efficiency gains, and investors betting billions that GitOps becomes the next de facto standard in enterprise DevOps.

The Data

The adoption wave is real, but it comes with caveats.

- According to a 2025 CNCF survey of 3,900 enterprises, 46% reported using GitOps in production and an additional 35% were piloting adoption, signaling mainstream traction compared to just 18% three years ago.

- Gartner’s 2025 Cloud Automation Forecast estimates that GitOps-driven automation will account for nearly 70% of Kubernetes deployments by 2027, up from less than 20% in 2022.

- IDC market tracking suggests that companies employing GitOps pipelines see deployment frequency improvements of 46% compared to traditional CI/CD setups, with an average rise in developer productivity by 18%.

- Yet cost efficiency is not guaranteed. A HashiCorp-financed study (criticized by some for bias) suggested that poorly implemented GitOps pipelines can actually increase infrastructure spend by 12–15% due to over-provisioning and constant cluster reconciliation loops.

So while Wall Street cheers adoption numbers, CFOs are still running the math. Enterprises pay the price for misconfigured pipelines, and nobody wants to admit to boards that “automation” inflated the bill.

The People

This story isn’t just about metrics, it’s about the people in the trenches.

A senior platform engineer at a Fortune 50 financial firm told Forbes: “Our DevOps culture was messy, with too many manual overrides. GitOps fixed a lot of that, but also sucked us into endless debates over pull request reviews. Suddenly, deployment changes looked like code audits. It smells like process theater more than agility sometimes.”

Christian Hernandez, Senior Principal Technical Marketing Manager at Red Hat, recently told Forbes: “GitOps has matured past the buzzword stage. Enterprise customers want consistent, auditable deployments across hybrid clouds. GitOps gives them that through the existing muscle memory of Git.”

Pulumi CEO Joe Duffy, speaking at last month’s DevOps Enterprise Summit, countered: “GitOps is powerful but rigid. Teams crave flexibility, not dogma. Automation that requires every change to pass through Git can slow delivery instead of accelerating it.”

Meanwhile, developers themselves are split. Startup engineers tend to love GitOps for the transparency, it keeps high-growth teams aligned. But enterprise engineers in regulated industries complain about “compliance paralysis,” where every change must clear multiple Git approvals before production. Sources say some engineers have even quit teams over “GitOps fatigue.”

The Fallout

The market consequences are already evident.

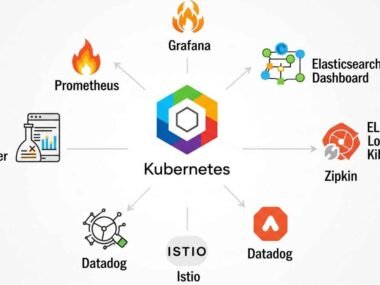

Red Hat’s aggressive GitOps positioning has forced competitors to adapt. AWS CodeCatalyst now markets a GitOps integration as part of its enterprise suite, while Google Cloud Anthos emphasizes GitOps-enabled multicloud cluster management. Even Microsoft, cautious at first, has expanded Azure Arc GitOps with AI-enhanced policy enforcement.

Investors are also recalibrating expectations. Wells Fargo analysts recently projected that GitOps tooling and services could add $3.5 to 4 billion in ARR across the top five cloud vendors by 2028. Yet in the same report, they warned that “if adoption stalls due to cultural backlash, valuations based on this tailwind may deflate quickly.”

For enterprises, the fallout comes with both gains and headaches. On the plus side, audits and compliance checks become easier, full deployment history is in Git. But the tradeoff? Longer lead times. A Forrester 2025 field study of 200 GitOps teams showed lead time to production improved by 42% for “elite performers” but degraded by 15% for “low maturity” adopters. Translation: GitOps magnifies both strengths and weaknesses, exposing organizational cracks.

Employees at major enterprises talk about morale strain, too. A leaked Slack thread from a global e-commerce company read: “Every hotfix now feels like filling out tax forms. We’re GitOps-compliant, but are we delivering value faster? Honestly, not sure.”

And consumers? They may not know “GitOps” by name, but they notice impact in more stable app updates or, conversely, delays in feature rollouts.

Developers themselves are bearing part of the fallout. Burnout is rising within platform engineering teams tasked with standing up GitOps pipelines. “We’ve turned Git repos into the battleground for infrastructure changes,” said one engineer at a SaaS firm. “Now every failed build feels like an organizational referendum. It’s exhausting.”

And security? That’s another red flag. Several security leaders warn that supply chain risks are multiplying with GitOps, since malicious commits or dependency issues can cascade automatically into production if controls fail. Sources say at least two financial institutions quietly suffered outages in early 2025 traced back to compromised Git workflows.

Closing Thought

GitOps is no longer a fringe experiment. With Red Hat leading the charge and cloud giants racing to embrace it, GitOps has become the flashpoint for how modern organizations deploy applications at scale. Investors are optimistic, enterprises are experimenting, and developers are debating whether this evolution empowers them or bureaucratizes them.

GitOps is undeniably reshaping the conversation around cloud deployment. The data points to accelerating adoption, and companies like Red Hat are reaping financial benefits for now. But beneath the glossy investor slides are operational frictions, developer fatigue, and questions about whether GitOps principles scale for all organizations—or just become another buzzword layered atop DevOps.

The core question remains unanswered: Is GitOps the inevitable backbone of cloud automation, or just another fleeting hype cycle that will buckle under its own rigidity?

Because if GitOps succeeds, Red Hat and its parent IBM stand to win big. If it fails? The market may learn, once again, that not every new DevOps religion saves productivity.