Cloud revenue is projected to surpass $1 trillion by 2030, according to Gartner, but one of the most surprising technologies reshaping the landscape right now isn’t machine learning—it’s WebAssembly (Wasm). Once a niche runtime environment used to speed up browsers, Wasm has quietly become the centerpiece of new cloud-native strategies.

Microsoft is aggressively leaning into Wasm, doubling down on open-source contributions like Wasmtime and WASI (WebAssembly System Interface). The pivot is stirring debate: some investors wonder if this represents genuine differentiation in the cloud wars, or just another flashy buzzword pivot like blockchain or the metaverse. Developers, meanwhile, see both promise and risk—a more portable, lightweight way to run apps, but one that could threaten traditional container-based stacks.

The Data

Here’s the thing: the hype around Wasm isn’t just hot air. The numbers paint a picture of accelerating adoption.

- 80% of enterprises will run Wasm-based workloads in production by 2030, according to a forecast from the Cloud Native Computing Foundation (CNCF, 2024). That’s a staggering jump from less than 8% in 2022.

- Microsoft Azure’s internal pilots show Wasm workloads boot in 30–50 milliseconds, compared to around 500–800 milliseconds for traditional Docker containers. For large-scale services, that’s not a rounding error—it’s the difference between dropping or keeping millions of concurrent users.

- Developer interest is booming: GitHub data shows Wasm-related repos grew 120% year-over-year, outpacing Kubernetes adoption rates at a similar stage of maturity.

- Venture funding for Wasm-focused startups hit $130 million in 2023, as tracked by PitchBook—a modest figure compared to AI hype cycles, but explosive growth for what was previously an esoteric developer tool.

- Fastly’s own Compute@Edge platform, which runs on Wasm, saw a reported 80% increase in usage year-over-year, though the company struggles to turn that growth into significant revenue expansion.

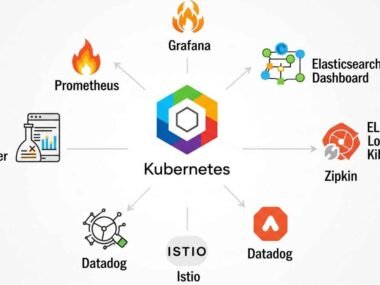

While these stats are impressive, they also raise a difficult question: if Wasm matures as quickly as projected, what happens to the billions invested in container orchestration platforms like Kubernetes and service meshes? Some analysts argue Kubernetes isn’t going away anytime soon; others whisper that it could become the “legacy system” of the late 2020s.

The People

To understand the stakes, we spoke with insiders at Microsoft and outside experts.

A former Azure executive, who requested anonymity to speak candidly, told Forbes: “Microsoft lost the mobile OS race, and they don’t want to be caught flat-footed in cloud runtimes. Wasm gives them a chance to leapfrog AWS and Google on efficiency.”

Matt Butcher, CEO of Fermyon (a Wasm-based startup with venture backing from Insight Partners), echoed this: “Containers were built for a world where VMs were too slow. Wasm is built for today’s edge and serverless-first world. The economics are night and day.”

Not everyone is convinced. Corey Quinn, an AWS cloud economist known for his industry skepticism, posted bluntly on X: “Wasm is cool tech. Will it save customers money? Only if vendors stop inventing new lock-in strategies. Don’t bet on it.”

This skepticism resonates with IT managers still cleaning up after the microservices boom. One Fortune 500 CTO described Wasm adoption to us like this: “We’re barely paying down the technical debt from Kubernetes. Now vendors tell me Wasm will simplify everything. Call me unconvinced until I see a stable ecosystem.”

The Fallout

If Wasm takes off, the ripple effects could be massive—economically, operationally, and competitively.

1. Cracks in the Container Empire

Docker, founded in 2013, was once hailed as the future of software packaging. But with Wasm apps running faster, cheaper, and more securely, demand for containers could erode. The Docker company has already pivoted to integrate Wasm support, signaling it doesn’t want to be left behind.

2. Cloud Providers Re-arming

Microsoft’s Azure team is marketing Wasm as a “serverless-native” runtime, pairing it with their Function-as-a-Service offerings. If they succeed, AWS Lambda—the current market leader—faces serious disruption. Google, meanwhile, upped its Wasm investments after spinning out the WasmEdge project in partnership with the CNCF.

Here’s the kicker: if Wasm workloads really deliver 5–10x cost efficiency, enterprises will start migrating aggressively. That means cloud providers face not just a feature race, but a revenue compression problem. If your service costs less to run, customers will demand those lower prices.

3. Developers Get More Control

Unlike containers, Wasm modules are architecture-neutral, sandboxed by design, and easier to deploy at the edge. That could rewire how developers build global-scale applications. But it also shifts the balance of power away from cloud vendors; if workloads are portable, multi-cloud suddenly becomes more feasible.

4. Investors Hedge Bets

Public markets haven’t priced Wasm in—yet. But venture capital is moving fast. In 2024 alone, Wasm-focused startups raised over $150 million, according to Crunchbase. Insiders compare the energy to Kubernetes circa 2015: fascinating tech, messy ecosystems, but undeniable momentum.

“This smells like another inflection point,” one tech banker in San Francisco told us. “If Wasm matures, cloud compute margins collapse. That’s either an existential threat—or a trillion-dollar opportunity—depending on your balance sheet.”

For all the optimism in developer circles, Wall Street remains skeptical. Fastly’s stock is down nearly 60% from its pandemic-era highs, and analysts at JPMorgan labeled its Wasm push “high-risk, high-reward” in a 2024 note. Investors are still waiting for evidence that WASM workloads can generate recurring enterprise-grade revenue instead of isolated developer experiments.

Meanwhile, established cloud players are hedging their bets. Cloudflare Workers already supports Wasm execution, and Google is experimenting with Wasm runtimes inside Kubernetes clusters. Even AWS, cautious at first, quietly launched Wasm support in its Lambda service, though without splashy promotion. The takeaway is clear: none of these giants is ignoring the momentum.

The geopolitical layer makes things even messier. Security policymakers in Europe point to Wasm’s isolation model—where applications run in tightly sandboxed environments—as a potential solution for reducing supply-chain attack risks. “If regulators start mandating Wasm-like safeguards for critical workloads, that could accelerate adoption overnight,” argued analyst Marta Velasco of Forrester Research.

The flip side? Such mandates could fracture standards. If the EU and US diverge on runtime compliance, companies might have to support multiple Wasm implementations, raising costs instead of lowering them. That nightmare scenario isn’t lost on CISOs already stretched thin.

Closing Thought

The rise of WebAssembly in the cloud feels both inevitable and uncertain. The technology solves real pain points, but hype cycles have burned investors before. Think about blockchain, VR, or even the first wave of containers—promises outpaced reality, and consolidation came brutally.

Microsoft’s heavy bet on Wasm is bold, maybe even desperate, as it looks to claw more market share from AWS. The numbers suggest Wasm could be the real deal. But investors should ask: will it truly transform economics across the cloud, or will it end up as another layer of abstraction, buried under marketing gloss?

Here’s the billion-dollar question: if Wasm changes the cloud cost curve, are we looking at the next cloud-native revolution—or the next overhyped detour?